The currency pair reached local lows last week according to our expectations but formed a reversal pattern later. EUR/USD’s main drivers were Eurozone’s PMIs.

French Manufacturing PMI was better than expected and reached 50,6, meaning expansion of manufacturing sector. Services sector has also shown growth towards 51,7. As for Germany, services sector had a non-significant decline and manufacturing sector stays below 50.

German Business Climate declined to 97,9 as compared to the previous reading. Experts expected the indicator to remain unchanged at 99,2.

As for the US, FOMC member Bullard has told last week that the FED is likely to decrease rates in case if inflation stays below target levels.

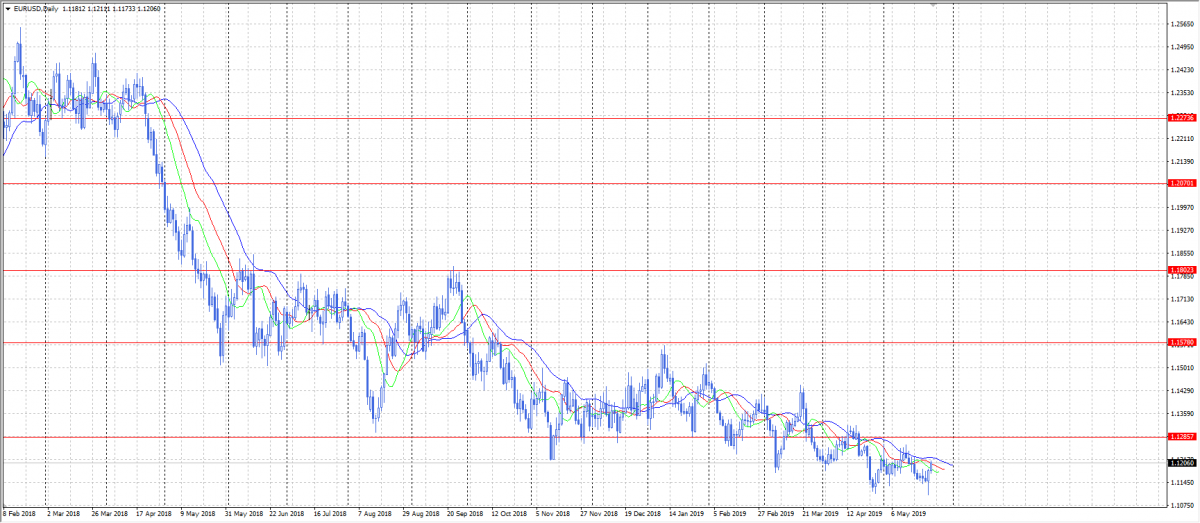

We expect the currency pair to grow this week towards 1,1285. The currency pair stays within a narrow range for a couple of months already. We have a reversal hammer pattern on the daily chart.